BIDVEST INSURANCE HELPS VICTIMS OF VEHICLE THEFT

MEDIA RELEASE FOR IMMEDIATE DISTRIBUTION

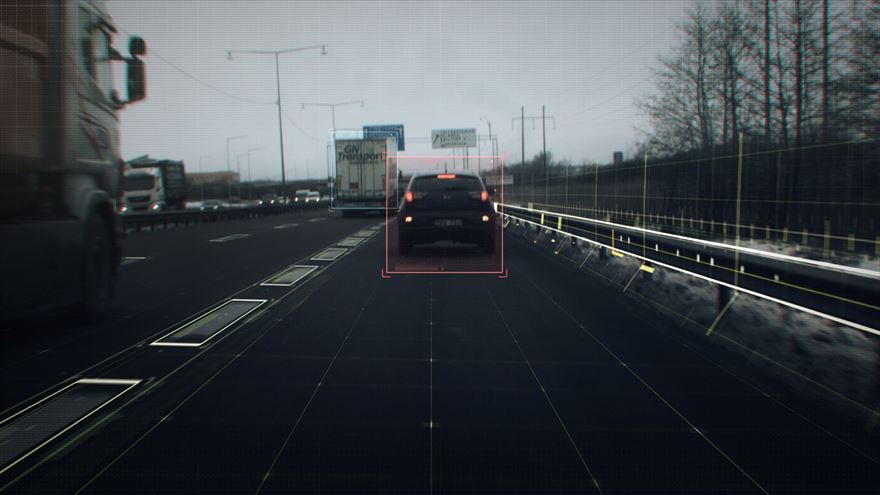

It’s a sad fact of life in South Africa that crime is a serious reality. For instance, did you know a vehicle is stolen or hijacked in South Africa approximately every four minutes? But now Bidvest Insurance has come up with a ground-breaking new product to help ease the emotional and financial trauma of victims of this growing scourge.

The product in question is called TheftBuster, and it has been launched in order to help South Africans whose vehicles have been stolen or hijacked.

According to Phil Donnelly, the executive head of sales and marketing at Bidvest Insurance, there are many consequences of vehicle theft. “Firstly there’s the inconvenience and stress associated with a theft. Then there’s the trauma – because vehicle theft is so often associated with violence. But not only this, there are also many other financial consequences that motorists just don’t consider,” he comments.

BIDVEST INSURANCE HELPS VICTIMS OF VEHICLE THEFT

For instance, firstly the motorist needs to pay an insurance excess, but then there are numerous other expenses which are often overlooked – such as replacing car keys, house keys, remotes and other personal items that may have been stolen with the car. “In the event of a hijacking the first thing they want from you is your cell-phone and wallet, which means the victim often has to replace bank cards, driver’s licenses, sim-cards, ID books and the like. As for the inconvenience of not having a vehicle… not everyone can afford to go out and hire a car to use in the meantime,” Donnelly comments.

Enter TheftBuster, the brainchild of Bidvest Insurance. Motorists can now make an affordable once-off or monthly payment, which gives them access to substantial benefits in the event of a vehicle theft. TheftBuster is currently the only standalone product of its type in the country.

“If a vehicle is stolen or hijacked, TheftBuster provides cover for the insurance excess and it pays towards other items that may have been stolen along with the vehicle. Items such as home or office keys and remotes are covered, for instance, as are the costs of replacing identity or driver’s licenses. We also cover car hire,” explains Donnelly.

Assuming the stolen vehicle is not recovered, TheftBuster also pays R6 000 towards the victim’s replacement vehicle if it’s purchased through an approved dealership.

If the vehicle is recovered, TheftBuster also kicks in. “We know that it’s extremely unpleasant to get your stolen car back in what’s often a trashed and dirty condition, which is why we send the vehicle for a full professional interior and exterior valet,” explains Donnelly.

Then, of course, there is the psychological damage and emotional trauma associated with a theft and especially a hijacking. “I’ve been on the receiving end of a hijacking so I can tell you that trauma counselling is a must. It helped me, my wife and my children who were also affected, which is why we also pay for trauma counselling,” Donnelly notes.

TheftBuster provides coverage for the owner of the car, members of his or her immediate family as well as any authorised driver.

Donnelly says the product is already being extremely well received in the marketplace. “The reality is that we live in a country where crime is part of daily life. As a responsible company, we can’t stop crime, but we’d like to assist the victims and turn an unpleasant situation into a less stressful one. We believe that TheftBuster is ideally positioned to do just that,” he concludes.

CAPTIONS:

Phil Donnelly, the executive head of sales and marketing at Bidvest Insurance, explains that TheftBuster has been launched in order to help South Africans whose vehicles have been stolen or hijacked.

It’s a sad fact of life in South Africa that crime is a serious reality. For instance, did you know a vehicle is stolen or hijacked in South Africa approximately every four minutes?